Finance teams frequently struggle to strike a balance between daily tasks and larger company goals. With a lot on your plate, it’s simple to get bogged down in the daily grind, putting team and organizational alignment at risk.

So, what’s the solution? OKRs.

By implementing objectives and key results (OKRs) at the forefront, finance teams can improve focus and alignment.OKRs provide a clear path to achieving financial excellence by aligning teams and departments toward common goals.

In this blog, we’ll delve into 20 of the best Finance and Accounting OKRs examples that can help drive your organization’s financial performance to new heights.

Why Choose OKRs For Your Finance Team?

OKRs are a powerful and popular goal-setting framework that can be extremely effective for finance teams. Using OKRs for your finance team can drive focused and measurable outcomes. OKRs provide a structured framework that aligns financial goals with broader company objectives, enhancing teamwork and accountability.

Here are a few reasons why OKRs are a good choice for finance teams:

- OKRs align the finance team’s goals with the broader organizational objectives.

- OKRs provide clarity around what the finance team is working towards.

- OKRs help teams focus on what is most important.

- OKRs provide accountability for the finance team’s progress and results.

- OKRs can help improve communication and collaboration within the finance team and with other departments.

Advantages Of Using OKRs for Finance Team

Alignment with Strategic Goals

OKRs ensure that the finance team’s objectives are directly tied to the overall strategic goals of the organization. This alignment ensures that the team’s efforts contribute to the company’s success and growth.

Clarity of Priorities

OKRs provides a clear focus on what matters most. Finance teams can set specific and measurable objectives, helping team members understand their top priorities and avoid spreading themselves too thin.

Collaboration and Cross-Functional Alignment

OKRs often require collaboration between different teams to achieve shared objectives. In the context of finance, this can mean collaboration with departments like sales, marketing, operations, and more. This cross-functional approach can lead to more holistic and effective solutions.

Data-Driven Decision-Making

Setting specific key results often requires analyzing data and making informed decisions. This data-driven approach helps finance teams make better financial decisions that are based on evidence and insights.

Focus

Every department in an organization that uses the OKR methodology should be focused on achieving its goals.

Goals for the finance department goals may include:

- Strengthen and make the audit process transparent,

- Achieve budget variance of less than 5%, or

- Improve budget planning.

Whatever the goals, the finance team must concentrate on achieving them.

It is always a good idea to have multiple goals, but try to limit your list to no more than four.

The OKR methodology’s time-bound query aids in surfacing significant initiatives. It can significantly alter your approach because you will be more focused on the crucial tasks and able to address the less urgent ones later.

How to Set Up Effective Finance and Accounting OKRs

Setting up effective Finance and Accounting OKRs involves aligning your financial and accounting goals with your organization’s overall strategic objectives. OKRs provide a structured framework for setting and measuring goals, making them a valuable tool for improving performance and driving results.

Here’s how you can set up effective Finance and Accounting OKRs:

1. Understand Your Organization’s Strategy

Before defining your Finance and Accounting OKRs, it’s essential to have a clear understanding of your company’s broader strategic goals. This will help you align your financial objectives with the organization’s mission, vision, and long-term plans.

2. Define Clear and Specific Objectives

Each objective should be specific, actionable, and inspiring. They should answer the question, “What do we want to achieve?”

Examples of Finance and Accounting objectives might include:

- Improving cash flow management.

- Enhance financial reporting accuracy.

- Optimize budget allocation for growth.

3. Make Key Results Measurable

Key Results are the quantifiable milestones that indicate progress toward an objective. They should be specific, measurable, achievable, relevant, and time-bound (SMART).

For Finance and Accounting OKRs, examples of key results could be:

- Reduce accounts receivable aging by 20% by the end of the quarter.

- Achieve a 95% accuracy rate in financial reporting by implementing a monthly review process.

- Decrease operating expenses by 10% through cost-saving initiatives by the end of the year.

4. Limit the Number of OKRs

While it’s critical to cover important areas, having too many objectives can dilute focus and effectiveness. Aim for around 3-5 objectives per quarter or OKR cycle to ensure your team can give sufficient attention to each.

5. Regularly Review and Update

OKRs are not set in stone. Regularly review and update them based on changing business conditions, priorities, and feedback. This flexibility ensures that your finance and accounting OKRs remain relevant and aligned with the evolving needs of your organization.

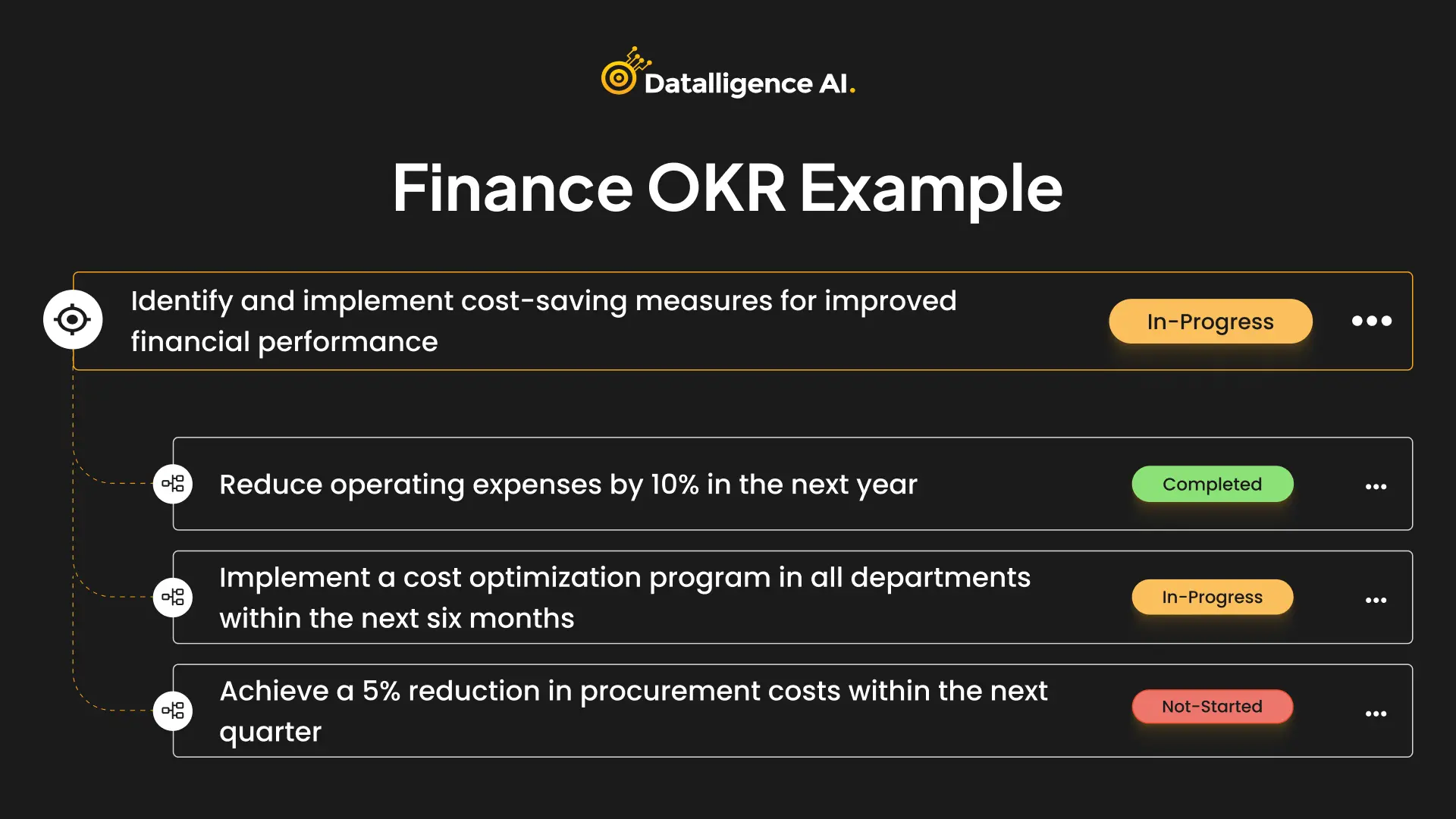

20 Best Finance OKR Examples for Accounting Teams

Finance okr examples brings about strategic alignment, focused execution, employee engagement, and improved communication. Here are common examples of OKRs in Finance.

1. Accounts Payable Department

Objective: Reduce tax liability

- KR 1: Reduce average time to process invoices by 20%

- KR 2: Increase the number of invoices processed per employee by 15%

- KR 3: Decrease the number of late payments by 25%

2. Accounts Receivable Department

Objective: Improve the Cash Collection Process

- KR 1: Reduce the average time to collect payment by 15%

- KR 2: Increase the percentage of invoices paid on time by 10%

- KR 3: Reduce the number of delinquent accounts by 20%

3. Financial Planning and Analysis Department

Objective: Improve Financial Forecast Accuracy

- KR 1: Increase the accuracy of revenue forecasts by 10%

- KR 2: Decrease the variance between actual and forecasted expenses by 5%

- KR 3: Increase the frequency of financial forecasting to monthly

4. Treasury Department

Objective: Optimize Cash Management

- KR 1: Increase the average daily cash balance by 10%

- KR 2: Reduce the cost of borrowing by 5%

- KR 3: Increase the accuracy of cash forecasting by 20%

5. Tax Department

Objective: Ensure Tax Compliance

- KR 1: Reduce the number of tax-related errors by 15%

- KR 2: Increase the percentage of tax filings submitted on time by 10%

- KR 3: Improve communication with tax authorities by responding to inquiries within 48 hours

6. Audit Department

Objective: Improve Internal Controls

- KR 1: Increase the number of control deficiencies identified by 20%

- KR 2: Reduce the time to close control deficiencies by 10%

- KR 3: Reduce the number of audit adjustments by 15%

7. Financial Reporting Department

Objective: Enhance Financial Reporting Process

- KR 1: Reduce the time to close the monthly books by 20%

- KR 2: Increase the accuracy of financial statements by 10%

- KR 3: Improve communication with stakeholders by issuing financial statements within 5 business days

8. Budgeting Department

Objective: Optimize Budget Planning Process

- KR 1: Reduce the time to prepare the annual budget by 15%

- KR 2: Increase the accuracy of budget projections by 10%

- KR 3: Increase the frequency of budget reviews to quarterly

9. Payroll Department

Objective: Improve Payroll Accuracy

- KR 1: Reduce the number of payroll errors by 10%

- KR 2: Reduce the time to process payroll by 15%

- KR 3: Improve employee satisfaction with the payroll process by 20%

10. Cost Accounting Department

Objective: Optimize Cost Accounting

- KR 1: Reduce the time to complete cost accounting reports by 20%

- KR 2: Increase the accuracy of product cost calculations by 10%

- KR 3: Improve the visibility of cost variances by creating monthly cost variance report

11. Financial Compliance and Regulatory Affairs Department

Objective: Ensure Regulatory Compliance

- KR 1: Achieve 100% compliance with all industry-specific regulations.

- KR 2: Complete quarterly compliance assessments without any major findings.

- KR 3: Implement robust data protection measures, meeting GDPR requirements.

12. Audit and Internal Controls Department

Objective: Strengthen Risk Management

- KR 1: Complete biannual internal audits with zero major findings.

- KR 2: Reduce average resolution time for control deficiencies to 10 days.

- KR 3: Conduct training to ensure 100% staff awareness of updated controls.

13. Credit and Collections Department

Objective: Improve Collections Efficiency

- KR 1:Decrease average Days Sales Outstanding (DSO) by 10%.

- KR 2: Increase successful collections calls by 20%.

- KR 3: Implement a customer portal for self-service payment and inquiries.

14. Risk Management Department

Objective: Strengthen Financial Risk Mitigation

- KR 1: Identify and mitigate five potential financial risks through proactive assessments.

- KR 2: Update the risk register with new emerging financial risks quarterly.

- KR 3: Achieve a 15% reduction in the company’s overall financial risk exposure.

15. Expense Management Department

Objective: Optimize Expense Control

- KR 1:Implement a company-wide expense management tool to track and manage all operational expenses.

- KR 2:Reduce discretionary spending by 15% through ongoing expense analysis and cost-saving initiatives.

- KR 3:Conduct a quarterly review of departmental budgets to identify and address potential cost overruns.

16. Investor Relations Department

Objective: Enhance Stakeholder Communication

- KR 1: Increase frequency of investor updates to bi-monthly.

- KR 2: Improve investor satisfaction survey score by 15 points.

- KR 3: Organize 3 successful investor roadshows for business expansion.

17. Investment Department

Objective: Optimize Investment Portfolio Performance

- KR 1: Achieve a portfolio return of 10% by the end of the fiscal year.

- KR 2: Conduct a quarterly review of investment strategy and adjust as needed.

- KR 3: Reduce investment management fees by 5% through negotiation.

18. Mergers and Acquisitions Department

Objective: Successfully Execute M&A Strategy

- KR 1: Complete due diligence for potential acquisition targets within 60 days.

- KR 2: Close two strategic acquisitions by the end of the fiscal year.

- KR 3: Achieve a seamless integration process for acquired companies within six months.

19. Revenue Growth and Optimization

Objective: Achieve a 15% increase in annual revenue.

- KR 1: Increase average deal size by 10%.

- KR 2: Expand customer base by 20% through targeted marketing campaigns.

- KR 3: Increase the average financial literacy score among employees by 15%.

20. Financial Communication Department

Objective: Improve Financial Communication and Transparency

- KR 1: Develop a quarterly investor communication plan with key financial highlights.

- KR 2: Publish monthly financial performance summaries for internal stakeholders.

- KR 3:Implement a feedback mechanism to gather insights on financial communications.

How Datalligence Simplifies OKRs For Finance Teams

While the benefits of implementing OKRs in finance and accounting are clear, the process of setting, tracking, and managing OKRs can be complex. This is where tools like Datalligence come into play.

Datalligence is a comprehensive OKR platform that simplifies the entire OKR lifecycle for finance teams. Our comprehensive OKR Platform consists of features like:

- Goal Setting

- Performance Management

- 360 Degree and Pulse Feed Back

- Task Management

Here’s how Datalligence simplifies OKRs for finance teams

- It provides a set of pre-defined OKR templates for finance teams. These templates cover a variety of common finance goals, such as improving profitability, reducing costs, and managing cash flow.

- It provides a central repository for all OKR-related documentation. This makes it easy for team members to find the information they need and stay aligned on the team’s goals.

- It integrates with other finance software, such as accounting software and budgeting software. This allows teams to seamlessly connect their OKRs to their day-to-day work.

- Datalligence provides insights into how well the company is performing against its goals. This information can be used to make better decisions about the allocation of resources and the development of new strategies.

In conclusion, the integration of OKRs within finance and accounting departments can significantly enhance financial performance, streamline processes, and drive organizational success. Tools like Datalligence simplify the implementation and management of OKRs, empowering finance teams to set and achieve ambitious financial goals. By leveraging the power of OKRs and utilizing platforms like Datalligence, finance teams can navigate the complexities of financial management with clarity, focus, and measurable results.

FAQs

What are Finance OKRs, and why are they important?

Finance OKRs (Objectives and Key Results) are specific goals set by finance teams to improve various aspects of financial performance. They are important because they align the team’s efforts with the company’s overall financial strategy, driving efficiency and growth.

What are some effective finance department goals?

Effective finance department goals often include improving cash flow management, reducing operating costs, enhancing budgeting accuracy, and optimizing accounts payable/receivable processes.

How can Finance OKRs help in achieving departmental goals?

Finance OKRs provide a clear framework for setting measurable objectives and tracking progress. They help finance teams stay focused on critical goals like revenue growth, cost reduction, and strategic financial planning.

How do you set Finance OKRs for your team?

To set Finance OKRs, start by identifying key areas for improvement or growth, such as budgeting, asset management, or profitability. Then, define specific objectives and measurable key results that align with these focus areas.

What are some examples of Finance OKRs?

Examples of Finance OKRs include:

- Objective: Improve budget accuracy.

Key Result: Reduce budget variance by 10%.

- Objective: Optimize cash flow management.

Key Result: Decrease the accounts receivable turnover by 15%.